For example, the direct materials necessary to produce a wood desk might include wood and hardware. Indirect materials are not easily direct materials variance formula and economically traced to a particular product. Examples of indirect materials are items such as nails, screws, sandpaper, and glue.

Create a Free Account and Ask Any Financial Question

The manager may try to overstate it to protect himself from being punished if something goes wrong during the production (unexpected waste or error). Our selling price is higher than the competitors and for sure it will impact the sale quantity. Sharing variance reports and findings with relevant departments fosters a collaborative environment where everyone is aware of cost control objectives. For instance, procurement teams can work closely with suppliers to negotiate better prices, while production teams can implement process improvements to reduce material waste. This cross-functional collaboration ensures that all aspects of the business are aligned towards achieving cost efficiency. Effective management of direct material variance can lead to significant savings and better resource allocation.

Total direct material variance

The price standard specifies how much each quantity of input should cost. These standards can be used to make financial projections and to evaluate performance by comparing the standards to actual performance at the end of the period. Any discrepancy between the standard and actual costs is known as a variance. Standard variances are considered a red flag for management to investigate and determine their cause. For Boulevard Blanks, let’s assume that the standard cost of lumber is set at $6 per board foot and the standard quantity for each blank is four board feet. Based on production and sales being equal at 1,620 units, the total standard cost would have been $38,880.

Purpose of standard costs LO1

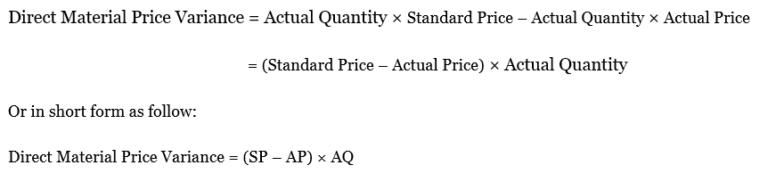

The total variable manufacturing costs variance is separated into direct materials variances, direct labor variances, and variable manufacturing overhead variances. Each of these variances are discussed in detail in the following sections. In this case, the actual price per unit of materials is \(\$9.00\), the standard price per unit of materials is \(\$7.00\), and the actual quantity used is \(0.25\) pounds. Direct materials quantity variance is a part of the overall materials cost variance that occurs due to the difference between the actual quantity of direct materials used and the standard quantity allowed for the output.

Accountants determine whether a variance is favorable or unfavorable by reliance on reason or logic. If more materials were used than the standard quantity, or if a price greater than the standard price was paid, the variance is unfavorable. This variance should be investigated to determine if the savings will be ongoing or temporary.

This setup explains the unfavorable total direct materials variance of $7,200 — the company gains $13,500 by paying less for direct materials, but loses $20,700 by using more direct materials. To apply this method to the Band Book example, take a look at the next diagram. Direct materials actually cost $297,000, even though the standard cost of the direct materials is only $289,800.

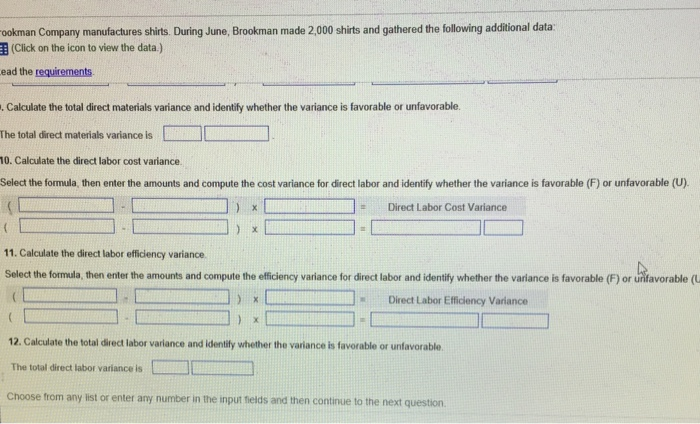

Refer to the total variable manufacturing overhead variance in the top section of the template. Total standard quantity is calculated as standard quantity of the cost driver per unit times actual production, or 0.25 direct labor hours per unit times 150,000 units produced equals 37,500 direct labor hours. The standard variable manufacturing overhead rate per direct labor hour was established as $3. Total variable manufacturing overhead costs per the standard amounts allowed are calculated as the total standard quantity of 37,500 times the standard rate per hour of $3 equals $112,500. During the period, Brad projected he should pay $112,500 for variable manufacturing overhead to produce 150,000 units. In this case, the actual quantity of materials used is \(0.50\) pounds, the standard price per unit of materials is \(\$7.00\), and the standard quantity used is \(0.25\) pounds.

The total direct labor variance is the total standard labor costs allowed of $675,000 less the actual amount paid for direct labor of $832,500, which is $(157,500) unfavorable. Refer to the total direct labor variance in the top section of the template. Total standard quantity is calculated as standard quantity per unit times actual production or 0.25 direct labor hours per unit times 150,000 units produced equals 37,500 direct labor hours. Total direct labor costs per the standard amounts allowed are calculated as total standard quantity (37,500) times standard rate per hour ($18) equals $675,000. During the period, Brad projected he should pay $675,000 for direct labor to produce 150,000 units.

- This overage in direct labor hours means that $22,500 of additional variable manufacturing overhead was incurred based on the standard amount applied per direct labor hour.

- Our selling price is higher than the competitors and for sure it will impact the sale quantity.

- However, it used only 34,100 tons of materials which resulted in a favorable direct material yield variance.

- Indirect materials are not easily and economically traced to a particular product.

- Standards are cost or revenue targets used to make financial projections and evaluate performance.

The management therefore needs to assess performance while taking all these relevant factors into account. Generally, the production managers are considered responsible for direct materials quantity variance because they are the persons responsible for keeping a check on excessive usage of production inputs. However, purchase managers may purchase low quality, substandard or otherwise unfit materials with an intention to improve direct materials price variance.

This is because the actual price paid to buy 5,000 units of direct material exceeds the standard price. Knowing that variable manufacturing costs were $181,500 over budget is helpful, but it doesn’t isolate the production issue or issues. Therefore, the next step is to individually analyze each component of variable manufacturing costs.

Let’s say our accounting records show that the company bought 6,800 board feet of lumber for that $38,080. Accountingo.org aims to provide the best accounting and finance education for students, professionals, teachers, and business owners. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.